Lecture 5 - Nash Equilibrium: Bad Fashion and Bank Runs

We first define formally the new concept from last time: Nash equilibrium. Then we discuss why we might be interested in Nash equilibrium and how we might find Nash equilibrium in various games. As an example, we play a class investment game to illustrate that there can be many equilibria in social settings, and that societies can fail to coordinate at all or may coordinate on a bad equilibrium. We argue that coordination problems are common in the real world. Finally, we discuss why in such coordination problems--unlike in prisoners' dilemmas--simply communicating may be a remedy.

📑 Lecture Chapters:

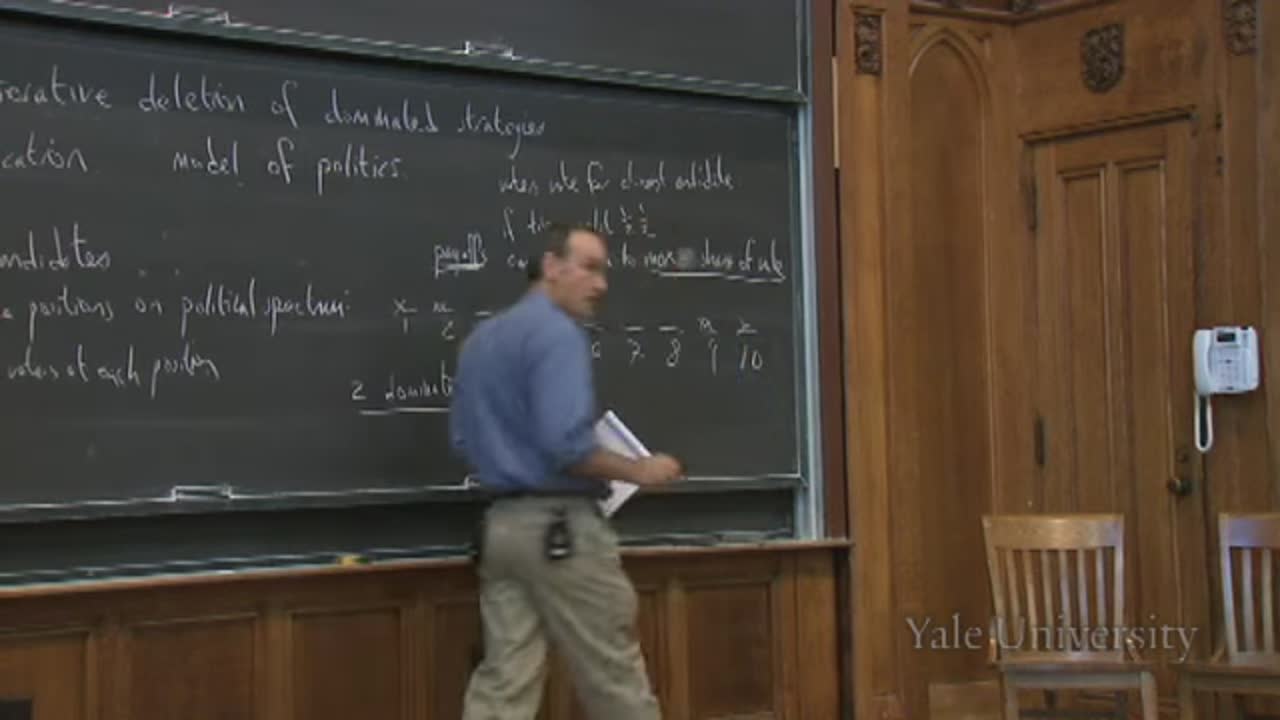

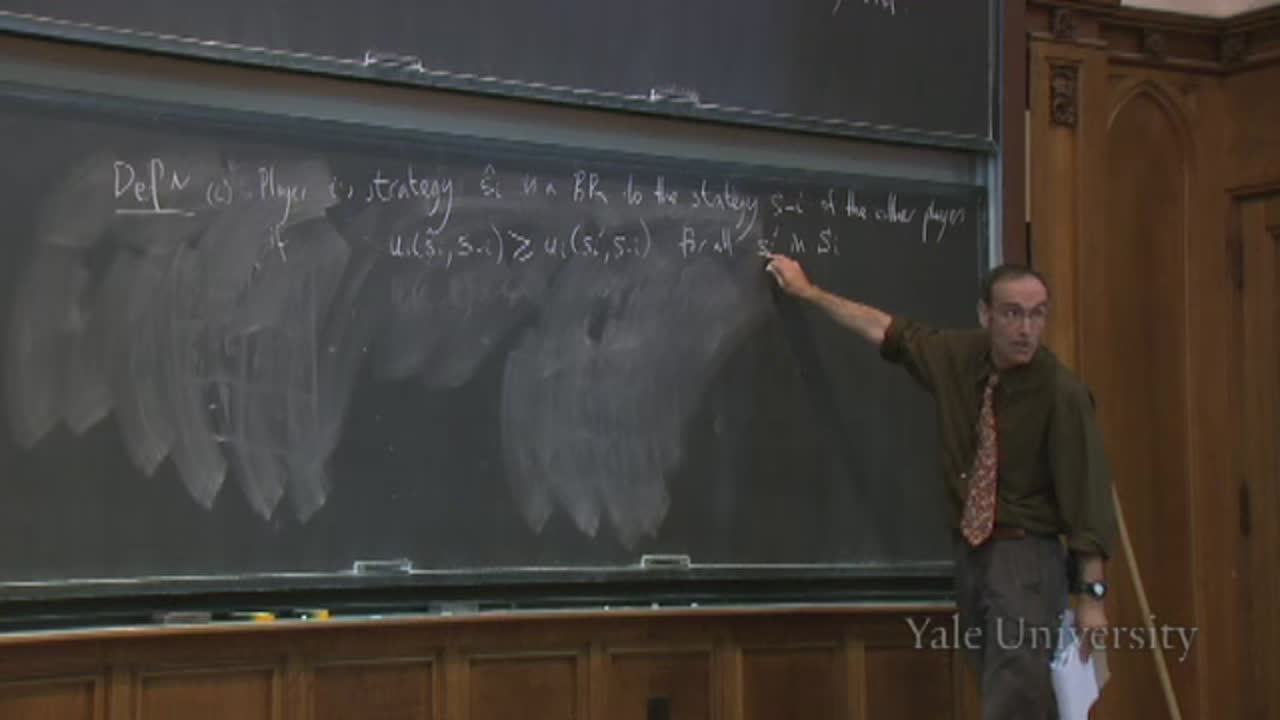

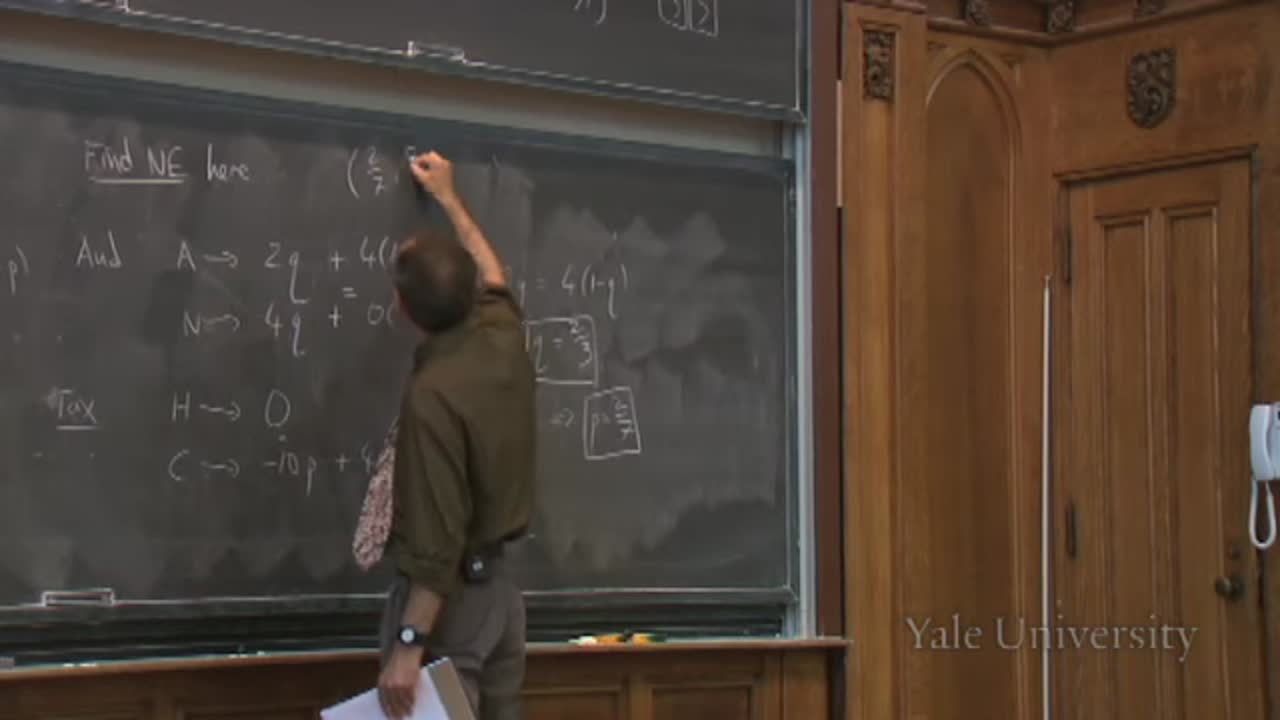

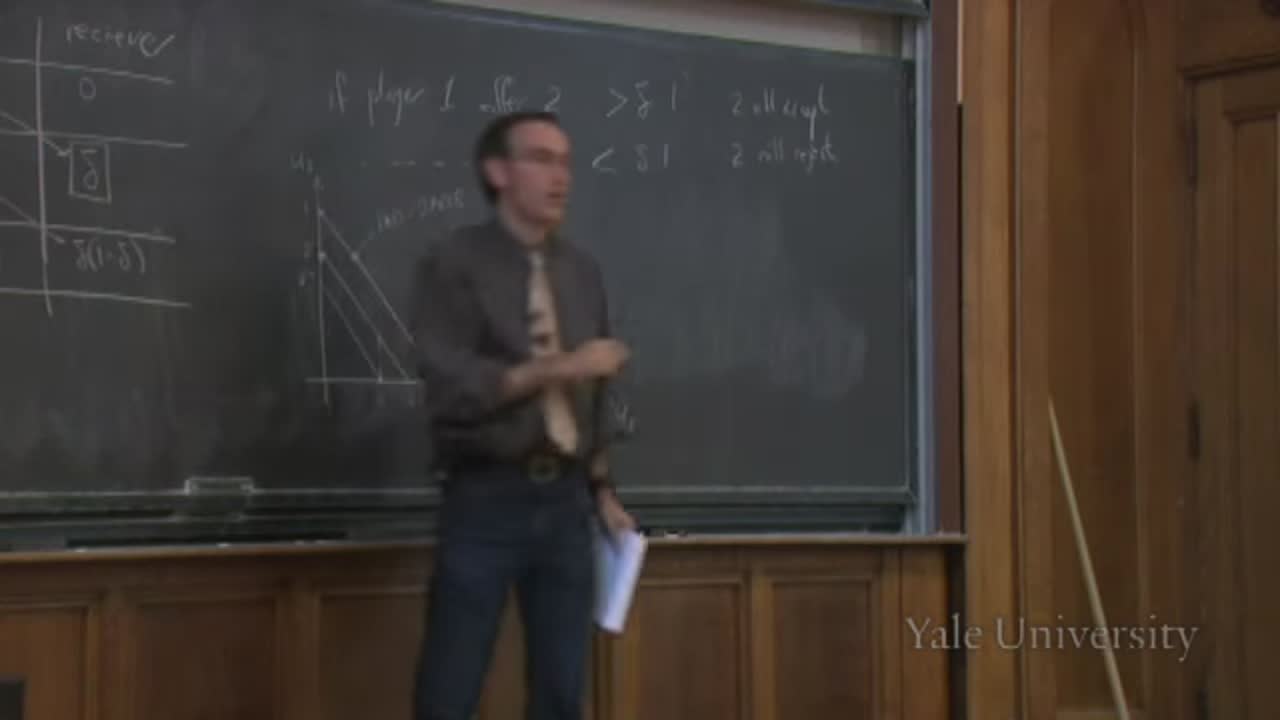

Nash Equilibrium: Definition [00:00:00]

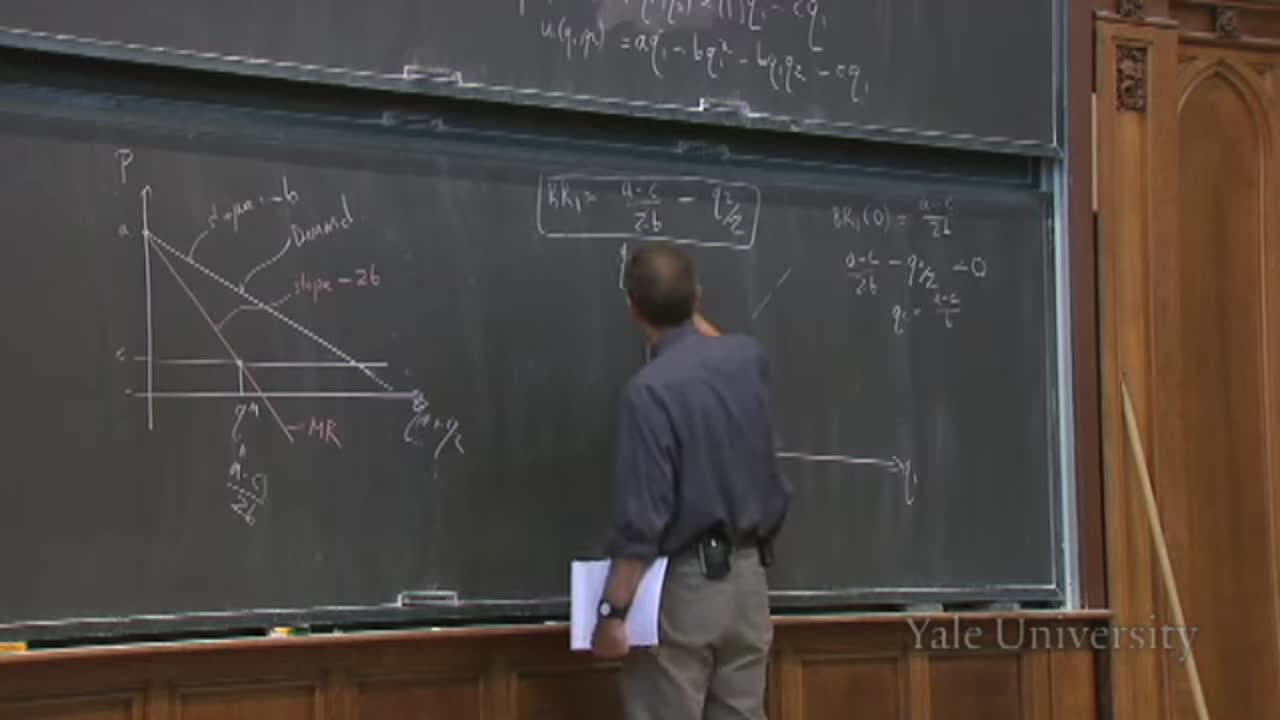

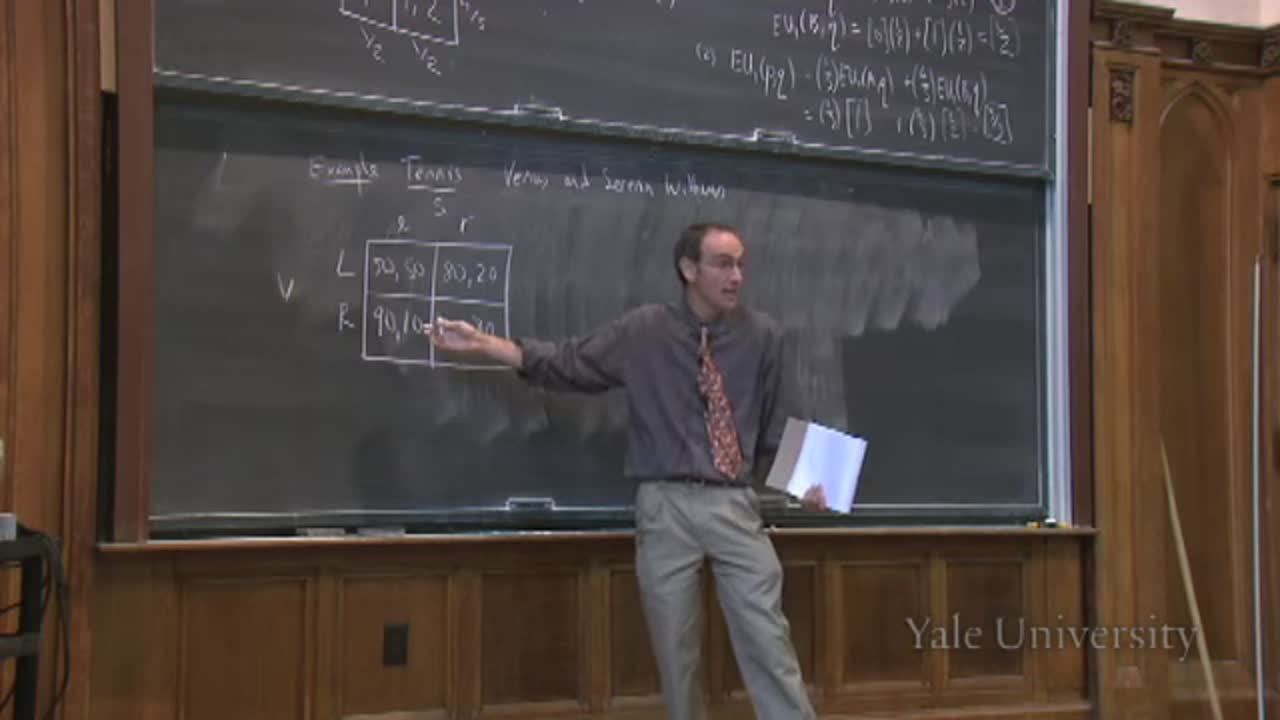

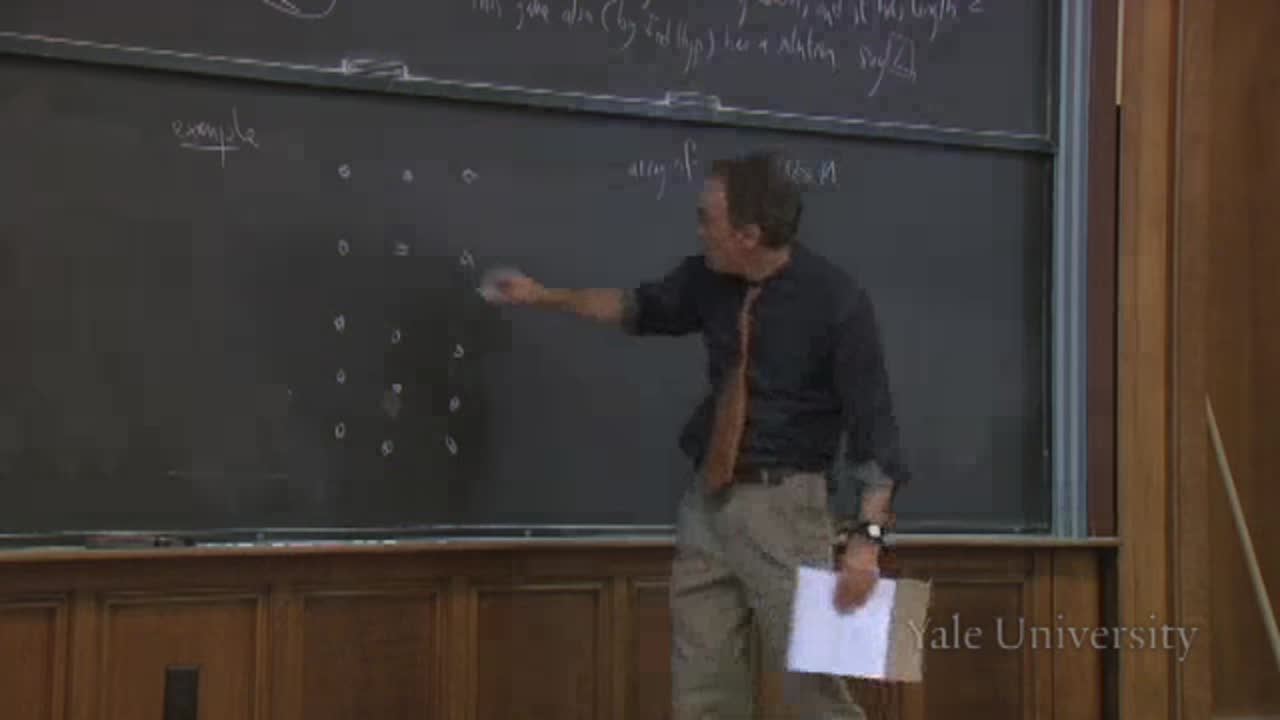

Nash Equilibrium: Examples [00:09:31]

Nash Equilibrium: Relation to Dominance [00:23:13]

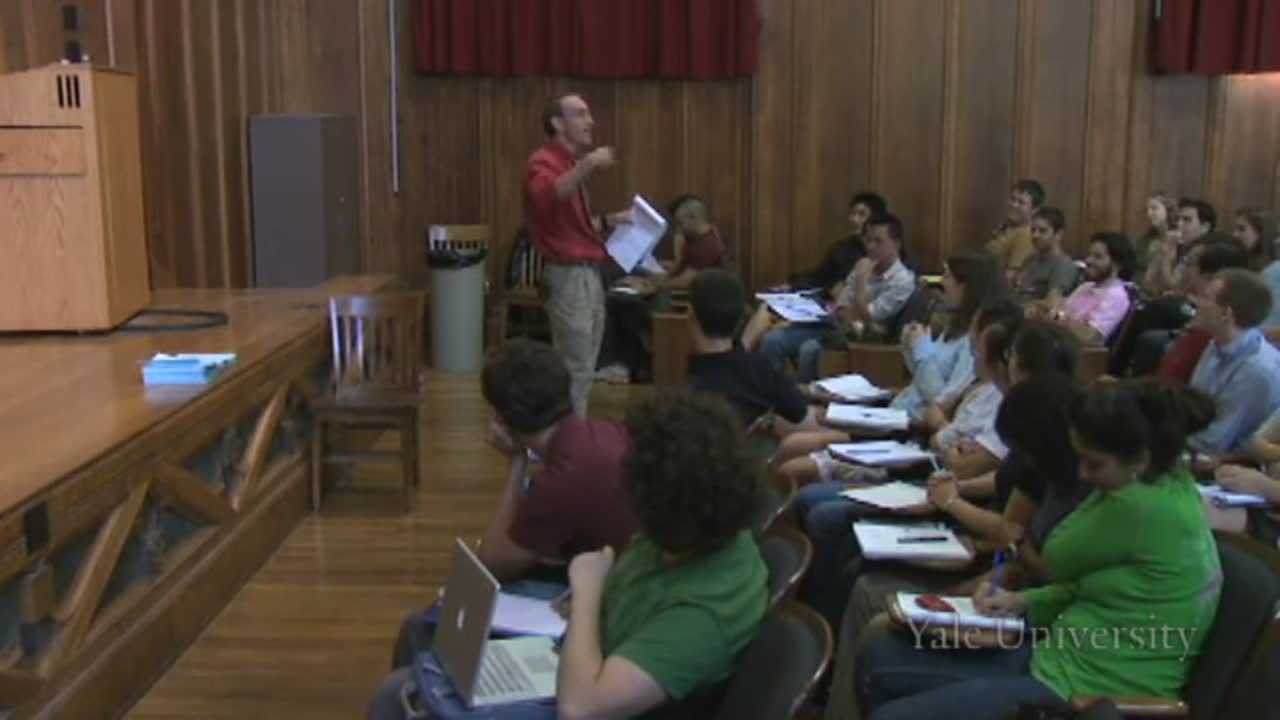

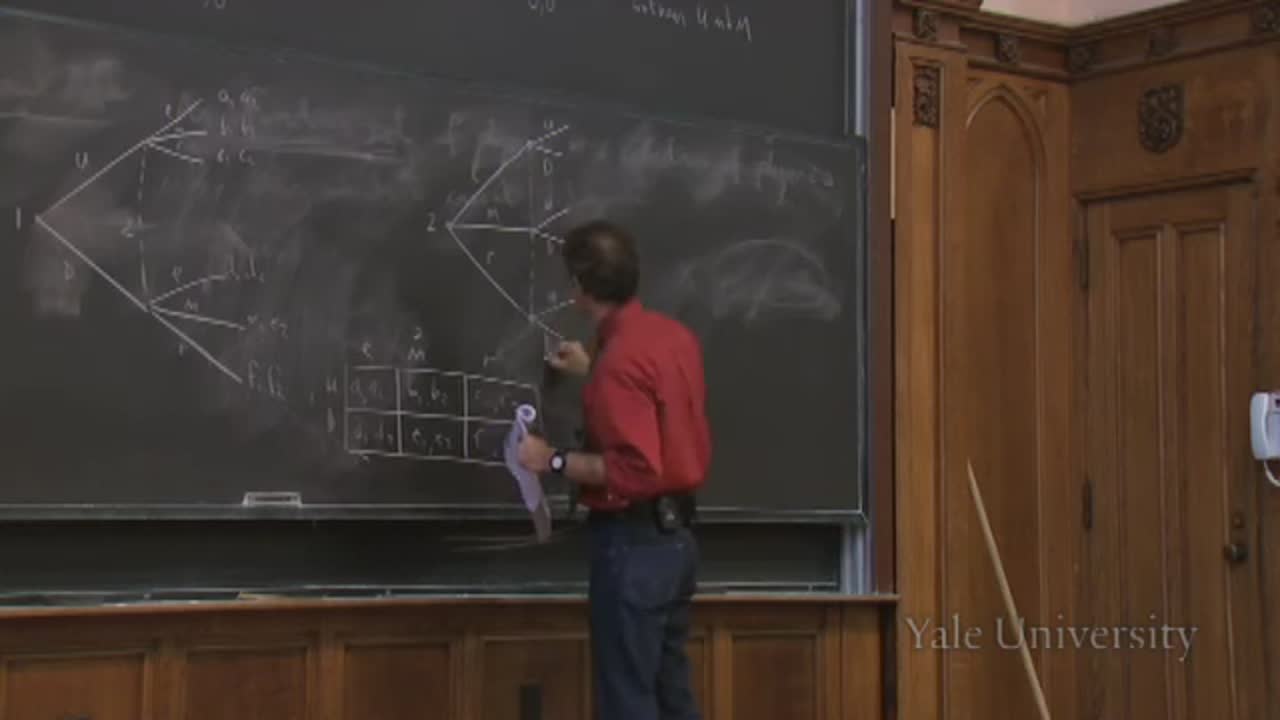

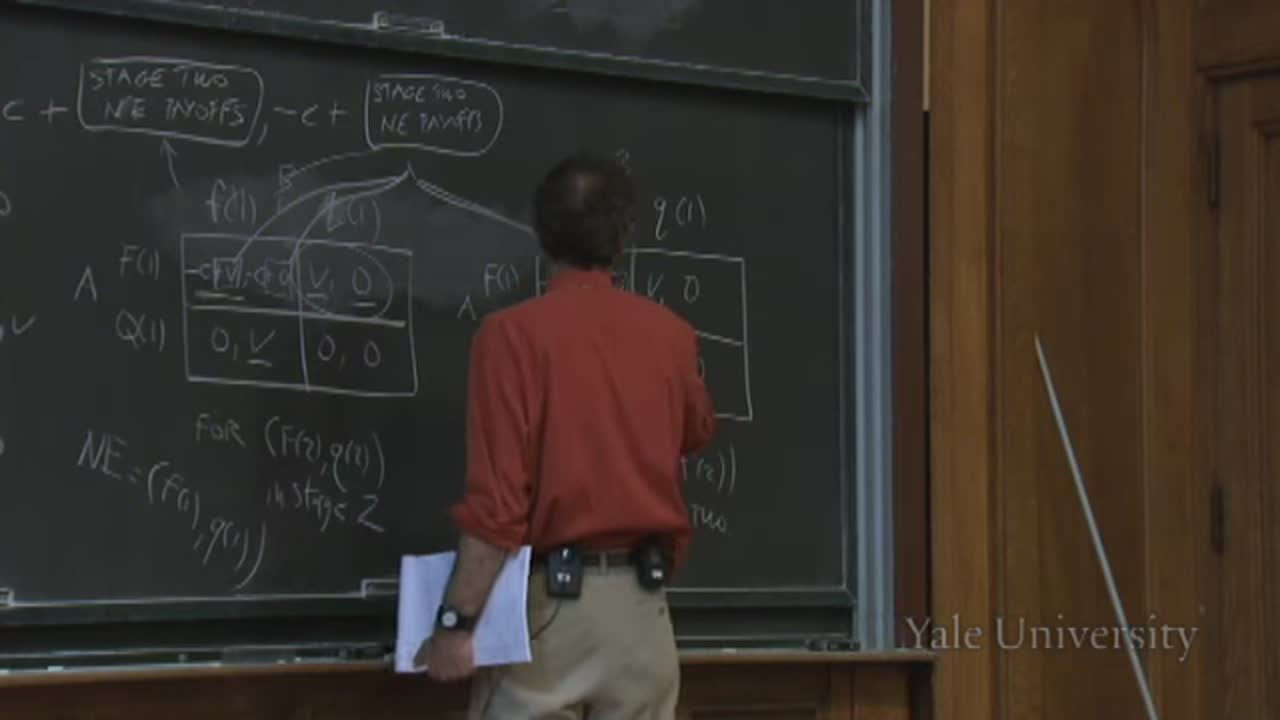

Pareto Efficient Equilibria in Coordination Games: The Investment Game [00:31:53]

Pareto Efficient Equilibria in Coordination Games: Other Examples [00:53:11]

Source: Ben Polak, Game Theory (Yale University: Open Yale Courses). Licensed under CC BY-NC-SA 3.0.

Hypha Official

Watch what matters. Create what pays.

This course is an introduction to game theory and strategic thinking. Ideas such as dominance, backward induction, Nash equilibrium, evolutionary stability, commitment, credibility, asymmetric information, adverse selection, and signaling are discussed and applied to games played in class and to examples drawn from economics, politics, the movies, and elsewhere.

-

Lecture 1 - Introduction: Five First Lessons1:08:32 Free

-

Lecture 6 - Nash Equilibrium: Dating and Cournot1:12:05 Free

-

Lecture 9 - Mixed Strategies in Theory and Tennis1:12:52 Free